Influence of Human Behaviour in Economy Study

Influence of Human Behaviour in Economy Study

- Classical Economy School

According to Richard Thaler’s book “Misbehaving”, in the history of modern economy, the multiful character of human being have been existed in economy study from the Enlightenment era. The Scottish economist, Adam Smith, who is famous to Publish ‘The Wealth of Nations’, that describe where is the Nation’s wealth comes from, that influenced to Karl Marx’s critic about capitalism. Was an exactly economist who emphasised imperfect Human condition, which are not always rational, but quit often selfish and Uncontrollable, called ‘Human passion’ in economy study. That would be a reason why he also published economy book called ‘The Theory of Moral Sentiments” (Thaler 2016).

It emphasised ethic and virtue as much as emphasised another aspects like, Private right and Natural liberty; familial right; state and individual right, because Adam Smith is concerned more about individual behaviour, which includes fairness and justice.

Thaler (2016) mentioned many examples that who concern about self control problem in human behaviour. He concerned that, behaviour economist; George Loewenstein (1980) has documented other treatment of “inter temporal choice” that emphasises the important of concept of ‘Will power’. Another economist, would be Ian Fisher who used the inter temporal choice in saving and planning consumption theory building. From the Thaler’s (2016) work, he explained that, before Paul Samuelson, who brought to mathematical method to conventional economy in US economy School in human behaviour was one of important aspect to concerning economic study. And also Thaler (2016) stated that, Neo classical school would be first turning point that rational character of human behaviour would be a main assumption in economy study.

- Neo Classical Economy School

Thaler lies that from the Neo Classical School character of the human being has been changed human character in study from economic entitle that has a human passion to rational decision maker. It was one of marginal revolution trend that classified human in their economic theory building (Thaler, 2016). If we concern that, Neo Classical School tried to upgrade to economy study as a so-called science, the rational behaviour only be a choice. It is important because the rational human being as an economic participator in Neo Classical economy dominates today’s economic thought with Keynesian economy. And many theoretical basic assumptions to build economic theories are adopting the view, which is arguable according to current behaviour economists’ explanation in non matched economic phenomena like credit card debt default case.

The Neo Classical fixed human character would be related with the academic three basic assumptions in their view about economy. First, People have rational preferences between outcomes that can be identified and associated with values.

Second, Individuals maximise utility and firm’s profits. Finally, People act independently on the basis of full and relevant information (Weintraub 2007). The generalisation of the human character is all arguable how much match with real each individual who makes their life in nowadays. The utility maximisation created neoclassical concept of “Homo Economicus” and leaded the marginal revolution that involved Jeremy bantam, and Alfredo Marshalls. The trend continued until 1933. Because in 1933, Joan Robinson published ‘The Economy of Imperfect Competition” and Edward Chamerlin published the theory of Monopolistic Competition”, those books challenged the rational human being concept in neoclassical theories.

- After Neoclassical and Recent trend

From such a trend, that always diversified human character, some time radical and also non radical so is able to make a mistake that would have been existed in different economic school, except Neoclassical school. In 1960’s behaviour economy school has been formed as a one economic school. Recent behaviour economy started from 1960’s cognitive psychology research human brain function as an information processing device (Duncan 1999). According to Duncan (1999), Psychologist, Amos Tversky and economist, Daniel Kahneman used the cognitive psychology model to analyse human decision-making process under risk and uncertainty to economic model of rational behaviour. This newly formed economic school is significantly influenced in conventional economic study trend.

For instance, it would be reasonable to argue the school’s influence with the fact that, five behaviour economists won Nobel Prices from1978 too recently in 2017. If we concern about their history to appear in mainstream, it would be enough to illustrate influence of behaviour economic perspective in conventional economy school.

And the behaviour economic school contributed several new theories in conventional economic studies, which are bounded rationality, Prospect theory, Inter temporal change, Nudge theory, Behaviour finance and so on. The arguing is important because it closely related with theoretical argument in this project that related with critique of conventional consumption theories in financialisation era, and human decision making theory, such as mental accounting approach in credit card default issue

One of example of the behaviour economic contributions might be Robert Shiller’s financial behaviour theory. Robert Shillers work called empirical analysis of assets prices” the Nobel prize commotion mentioned that commotion Concerned about "pioneering Contributions to financial market volatility and the Dynamics of asset prices. DrShiller used behaviour approach to define eight Volatility of investors for arguing his theory. Disclose more behaviour economic contributions in list of Nobel Prize would be a chance to have deep understanding about the behaviour economy.

- Harber Simon

In 1978, American psychologist, and economist, Harber Simon won the Nobel memorial prize of economy science (Nobel economy prize) due to his contribution of decision making process within economic organisation”. He was first behaviour economist who won the prize on the list. His boundary rationality theory is an idea that, when individual makes decision the rationality is bounded by tractability of the decision problem (Anon 2002).

In Simon’s 1957’s work, ‘Bounded rationality’ implicates the idea that our minds must be understood relative to the environment in which they evolved. Decisions are not always optimal. There are restrictions to human information processing, due to limits in knowledge (or information) and computational capacities (Simon, 1982; Kahneman, 2003). It indicates that, people are just partially rational. He used the term ‘Model of Man’ to describe his character of human being. Also he suggested, number of dimensions which conventional economic model of rational human being that can be made more realistic, in his perspective, that include limiting the types of utility functions, recognizing the cost of gathering and processing information, and the possibility of having a vector or multi-valued utility function (Simon 1957).

Simon suggested that, economic agency used heuristics to make a decision rather than strike rule of optimisation. The agency does this because of the complexity of the situations, and their inability to process the expected utility of every their actions.

“Humans take shortcuts that may lead to suboptimal decision-making. It means that Behavioural economists engage in mapping the decision shortcuts that agents use in order to help increase the effectiveness of human decision-making” (Simon 1957)

- Daniel Kahneman

Another famous behaviour economist, who won the prize in 1979, would be Daniel Kahenman. His Prospect theory would be another type of human decision-making process theory. The Nobel foundation announced the reason to choose Kaheneman that “for having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty” (THE NOBEL PRIZE. 2002).

Daniel’s academic contribution that Nobel committee concern was Prospect theory, which has two, stages that first editing stage and evaluation stage. In editing stage the risk would be simplified, and in evaluating stage, risky alternatives are evaluated using various psychological principles, which are:

- Reference dependence: When evaluating outcomes, the decision maker considers a "reference level". Outcomes are then compared to the reference point and classified as "gains" if greater than the reference point and "losses" if less than the reference point.

- Loss aversion: Losses are avoided more than equivalent gains are sought. In their 1992 paper, Kahneman and Tversky found the median coefficient of loss aversion to be about 2.25, i.e., losses hurt about 2.25 times more than equivalent gains reward.

- Non-linear probability weighting: Decision maker’s overweight small probabilities and underweight large probabilities—this gives rise to the inverse-S shaped "probability weighting function".

- Diminishing sensitivity to gains and losses: As the size of the gains and losses relative to the reference point increase in absolute value, the marginal effect on the decision maker's utility or satisfaction falls.

- David Laibson

David Laibson’s work is strongly related with household consumption study in recent trend. It is idea that explains household consumption based on consumer behaviour perspective rather than neoliberal theory, that concern household income and saving. In conventional economic consumption theories, from 1980’s trend has been changed from theories that concern more about micro and macroeconomic perspective then focusing human psychology. There were no significant academic contribution about credit card usage, only one article has been found, still it was related with consumer behaviour, but research about fee charging , not related with credit card debt payment (Agarwal et al., 2008).

His main contribution in consumption theory would be an ‘intertemporal choice’. It means that which people make decisions about what and how much to do at various points of time, when choices at one time influence the possibilities available at other points in time. These choices are influenced by the relative value that people assign to two or more payoffs at different points in time. Most choices require decision-makers to trade off costs and benefits at different points in time. These decisions may be about saving, work effort, education, nutrition, exercise, health care and so forth. Simply, if consumer has a possibility to get some benefit close to now they would chose the benefit rather than better benefit that has to wait.

This kind of inter-temporal choice perspective was shared with another conventional consumption theorists like fisher, Friedman, and Modigliani. But Laibson’s unique point is that in behaviour perspective, the character of consumer is not rational but more impulsive. So make a decision to choose option that easily approach rather than need to wait even the benefit is bigger. It is quit non-traditional view compare with another economist perused, because from neoclassical economic school market participators were always rational. So they have to choose later option, which promise better result.

Even it is acceptable in academy, this twisting human character in Laibson argument would be theoretical source to support the credit card default position in the case? In interest of industry approach, the theory has a high risk to use by financial capitalist to escape their involvement on the case rather than depend on CCDer’s position in the case. As we discovered, in Chapter 1, it should be not miss that basic structure of credit card industry has designed for industry not consumer, throughout risk hedging mechanism, and financial literacy and so on.

Due to the environment, conventional economist’s academic contribution would be strong supporting mechanism for financial capital rather than protect consumer’s right.

After 1980’s liquidity constraint argument, conventional consumption theories turn their point to responsibility from wage concern. Fortunately, conventional behaviour economist has been positioned as a alternative theoretical source to protect capital’s interest.

Conclusion

In history of academic development, Behaviour economy was a hybrid of two different academic traditions. Especially the aspect to research human decision-making process in economic would be a great achievement. And the contribution of the behaviour economy in consumption theory development is obviously significant. It has limitation to focus only credit user’s financial decision, but it would be another academic challenge to explain recent household economy, which has been suffered by liquidity constraint.

However, this project is questioning to the change with consumer perspective. Because adopting the behaviour economic perspective does not bring any benefit to majority of consumer, especially who defaulted. Honestly there is risk to cover the fundamental reason of the consumer credit system failure, if consumers take all responsibility. And also the situation that could not point may be right reason which would repeat the failure again and again.

These worries would be research in next part by tracking history of human character change in consumption theory development.

Consumption Theories with Two Different Human Characters

Before embarking on the Australian CCDDers research, it would be more convenience researches that historical transformation of conventional consumption theories with behaviour economic perspective. It is commonly accept that behaviour economic theories would be opposite idea of conventional consumption theory, or alternative economic theory for explaining recent consumption pattern partially, due to such behaviour economists have been accepted in mainstream. Even some case, behaviour economists are associating in mainstream economy institution, like Chicago University Richard Thaler case.

Beside, the behaviour economic consumption theory tend to explains financialisation era, debt base consumption trend, based on personal choice, but dining systemic inevitability, like average real income decrease, in this project it would be from 2008 in Australian household (Ch1) and .

It is distinguishable that, new economic study in household consumption, hybrid of economics and psychology, occupied the academic position that used to be covered by in conventional economic study, another hybrid of mathematic and political economy, if influence of the behaviour economy growth, then definition of economy would be changed again like marginal revolution. Following this thought, and before start full-scaled Literature review about mental accounting theory, which is main behaviour economic consumption theory would use in this project, This part would be review majority of conventional consumption theories, focusing consumer behavioural perspective, include human character that in the each theories were adopted. This project is not staying on the behaviour economic perspective, obviously opposite, historical and material perspective that concern more about systemic issue, but it would be good warming up to track development of consumption theories in each period’s economic transformation.

Keynes, Absolut Income Hypothesis

Keynesian consumption function model was a starting point of modern consumption theory argument after World War 2. Theory of aggregate consumption function was developed in his ‘General Theory (1936). Keynes treated consumption in a pervasive sense level without mathematical theories or significant econometrics method. Besides, his theory did not include utility maximisation perspective, and any consideration of consumer behaviour, except, his mind of human nature. His argument didn't have support from numerical data, except for his detail of experience (Keynes, 2009) However, Keynes put consumption theory in the middle of the macro economy. He also invented the idea of national income and production in his work, which compares with Kuzner’s work.

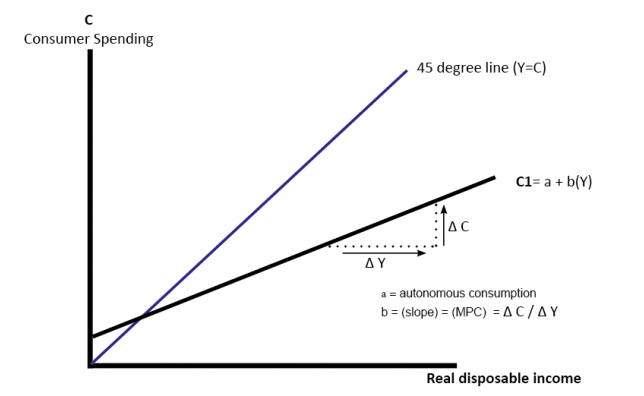

According to Keynes (1936) work, consumption function model, aggregate consumption is defined by disposable income (Keynes, 2009).

The consumption function equation

C = a + bY

The above function is represented graphically as follows;

Where 'a' represents autonomous consumption, which means consumption does not depend on disposable income like food while 'bY' represents inducted consumption that is affected by a consumer’s income level. 'b' is the marginal propensity of consumption (MPC), which means consumption increased due to an incremental increase in the disposable income level. From the Keynes’s MPC formula, if income (Y) increases, it follows that the marginal propensity of consumption will reduce.

b = ΔC/ΔY

Other chrematistic marks in Keynes’s consumption theory are First; when disposable income increases saving and consumption would increase.

0< C = MPA < 1

Secondly, when disposable income increases, the proportion of consumption (Aggregate percentage of consumption, APC) would be decreased.

APC > MPC

The model also suggests that as the level of income increases, the consumer spending too increases but at a lower rate compared to income. This simply means that people with high levels of income have a lower propensity to spend. As income increases, people can spend part of the income and save the rest.

Finally, Disposable income is the main factor of determination, nor interest rate.

To sum up, Keynes defines consumption in his ‘General Theory’ (1936), concerns only Marco economic perspective with simplified two different sorts of consumptions, which are autonomous and induced consumption. His research was based on psychological law

“The fundamental psychological law, upon which we are entitled to depend with great confidence both a priori from our knowledge of human nature and from the detailed facts of experience, is that men are disposed, as a rule, and on the average, to increase their consumption as their income increases, but not by as much as the increase in their income” (Keynes 2009)

As a result, his consumption theory does not have any assumption of specific human character, but briefly, Keynes has an idea of human nature that depends on uncertainty, and limitation of predict future, so such a human being makes a decision based on their expectation. And once make a decision, it will have irreversibility. Obviously, those kind of human would not be a rational decision maker. But point is he did not explain all economic activities, especially household, consumption based on the human nature, consumer behaviour perspective.

• Fisher Two Period Optimal Consumption Problem

Irvin fisher would be one of conventional economist who used expected consumer behaviour to build his theory. Irvin Fisher’s (1930) “Two-period Optimum Consumption Problem” was built by two-time period, consumption in youth and old. Fisher's model illustrated how rational, forward-looking consumers choose consumption for the present and future to maximise their lifetime satisfaction.

C = C (r, PV)

Present consumption affects to not only present income but also future expected income. Fisher also argued that consumption level is affected by the interest rates, which is different compared with Keynes. In addition, Fisher argued consumption would effect to average income level rather than resent revenue.

This 1930’s idea effected to Life cycle theory (1954) and relative income hypothesis (1949). Modigliani and Duesnburry built their consumption theories after conventional economist clam with Kuznet’s puzzle. Compare with Keynes’s present concern income base; Fisher extends the consumption theory to the future timeline, causing by assumption of consumer behaviour. This is important because of the adoption of rational consumer behaviour. Even it is assumption for explain the Kuznets Puzzle, maintenance of stable consumption pattern in long term period, but still it adopted rational human being who are hedge risk in their retirement plan as a generalised consumer character in economics.

• Duesnburry, Relative Income Hypothesis

After discover Kuznet’s puzzle, in 1949 the relative income hypothesis was developed to explain that consumption is related to habit formation and social interdependence (Duesenberry, 1949).

C = a Y + b [Yh/Y] Yz

0 < α < 1

(Yh/Y)Yz-------average consumption per person

Duesnberry proposes an individual consumption function that depends on the current income of other people. And also consumption related to my present and past income level, which pointed consumer behaviour perspective.

“For any given relative income distribution, the percentage of income saved by a family will tend to be a unique, invariant, and increasing function of its percentile position in the income distribution. The percentage saved will be independent of the absolute level of income. It follows that the aggregate saving ratio will be independent of the absolute level of income.”

(Duesenberry, 1949)

Relative income hypothesis that used demonstration effect as the main idea, also explains consumption pattern in a household with Irreversibility of consumption behaviour. For instance, it is hard to spend less in a household, which was once rich, even if it lost most of its wealth or income generating sources because there is a tendency to maintain a particular lifestyle.

Related Income Hypothesis would not analysis consumption with full-scale psychological perspective like behaviour economic theories but it is more reasonable to think that influence of human behaviour, in consumption pattern, is significant. It is more closed to theory that alternative method explaining the Kuznets Puzzle.

• Modigliani, Life Cycle Hypothesis

Another consumption theory that used consumer behaviour would be modigliani’s life cycle hypothesis. It was influenced by Fisher's timeline concept (Modigliani and Brumbergh 1954).

C = αW + βY

α---------------------------------------------------------------MPC for W

W-------discounted present value from income from property

Y----------------discount present value from income from labor

According to Modigliani, consumption is depending on the value of whole life, income rather than short-term income level. Also, consumption not only depends on income but also depends on the assets owned by the consumer. Household saving might be depending on the consumer’s age, and aggregate saving in society might be heavily influenced by proportion changing of the age group in the population.

Life cycle hypothesis adds to two factors, saving and increase of assets value to explain long-term consumption function, which APC is stable. It is meaningful because the life cycle hypothesis explains that except present income, another source of income would support to maintain long-term stable consumption. Milton Friedman used the term temporary income to describe the second income source.

• Friedman, Permanent Income Hypothesis

In 1957, Milton Friedman proposed the Permanent Income Hypothesis (PIH) that maintains the households spend a fixed fraction of their permanent income on consumption. It became a standard consumption model in the conventional economy.

C = aYp just, Y = YP + YT

a--------------------------MPC

YP-----permanent income

YT-----temporary income

The formula explains that, household consumption depends on the average income expected in the future not income earning in the present. From this logic, temporary income would be saving, and permanent income will be consumed mainly.

MPC out of permanent income is constant and equal to the APC in the long term period, which is consistent with Kuznet’s (1946) empirical findings. The MPC is also the same for all households. But if Yp increases in the short-term period, because it is not consistent in the short term period, APC would reduce.

Friedman’s PIH assumes that, household would earn regularly, which is not available any more. And temporary income would be saving in the bank. That can not represent reality (Australian household saving has been reduced until 2008).However, it is arguably the permanent income hypothesis in financialisation era, because there is uncertainty in employment, for instance, labour market flexibility has been increased (Reserve Bank of Australia. 2018 b, Flavin1981), so there is no evidence those consumers save their temporary income constantly in Financialisation era.

However, the PIH has been built on the assumption that human being is rational. Even the situation that, human being faced uncertainty of future, in the theory, Friedman’s work (1957) showed that, he adopts neoclassical human concept properly (Friedman, 2015).

• Laibson, Immediate Satisfaction Hypothesis

In 2000’s argument about the consumption theories have been changed to focusing on a human behaviour economy aspect. The Liabson who mentioned before, His consumption theory, immediate satisfaction hypothesis, the discount rate in each period would be below:

βδi-1 but 1 > β > δ >0

β----consumption

δ-------------saving

It illustrates that first, the common consumer tends to save less and to consume more than they need because human beings are not strong enough to ignore consumption temptation. It means that consumers, financially, highly discount very recent present. From the logic, Laibson argued that first, present income would be influenced in present consumption. Secondly, there is no coherence in the individual’s consumption pattern, and finally, the Government should force individuals to regularly save a certain amount of their income (Campbell, 1987).

It isobvious that his consumption theory was built based on behaviour economic theory called ‘intertemporal choice’. After 1980’s liquidity constraint argument, which rasiedtobin’s consumption theory, and other conventional consumption theories, contain radical decision maker perspective, would disappear. And ISH would be one of the behaviour consumption theory that accepted in mainstream economic trend, because conventional theory, concern saving and wage, could not related with resent household consumption pattern, financialised consumption, including credit card usage.

Conclusion

When literatures mention about behaviour, it is possible to understand so many different ways. But this part only concern about two differences, which are rational human character, and irrational. Economic activities are human activities; it is possible to explain economic phenomena based on human capacity. However, when build economic theory with assumption that human being is not rational, it would be a good academic source pointing individual’s responsibility, and diversified capacities. But if it mixed with some theories that assumed human being is rational choice maker. The irrational human being based theory would be a tool for covering systemic responsibility, causing economic failure, like debt default. And also in Australian law, as a duty of care, the irrational decision maker should be protected from the financial treat that accidently they can create, and received alarming before access the financial service.

This part reviewed an assumed human character of each conventional consumption theories, Keynes’s AIH. Some case, even economist believed irrationality of human being, the theory organised with rational decision maker concept. And also it was a possibly to find that irrational character in the theory, for instance, Duesnburry’s RIH and recent Labison’s HIS. But mainly, consumer behaviour would be assumed rational decision-maker who is able to prefer financial source to expected future consumption in difficult financial situation, mentioning inModigliani’s LCH and Fisher’s model.

In this project the issue would be the case decision-makers are irrational enough to make an irrational decision, which is main idea of mental accounting theory that will experiment candidate’s level of self-consciousness in each stages by qualitative method.

Mental Accounting

Behaviour economist Richard Thaler lies that mental accounting operate differently, compare with regular explanation, finding in economy text book (Richard, 1999). Thaler continue that there is no equivalent source for the convention of the mental accounting. Researcher would learn by observing behaviour and inferring rule. Tlaer illustrates that, there are three components of mental accounting.

First, the captures of how outcomes are perceived and experienced as well as how decisions are made and subsequently evaluated. The accounting system provides the inputs to do both ex ante and ex post cost-benefit analyses. This component is illustrated by the anecdote above involving the purchase of the quilt. The consumer's choice can be understood by incorporating the value of the 'deal' (termed transaction utility) into the purchase decision calculus. .

Secondly, a second component of mental accounting involves the assignment of activities to specific accounts. Both the sources and uses of funds are labelled in real as well as in mental accounting systems. Expenditures are grouped into categories (housing, food, etc.) and spending is sometimes constrained by implicit or explicit budgets. Funds to spend are also labelled, both as flows (regular income versus windfalls) and as stocks (cash on hand, home equity, pension wealth, etc.). The first two anecdotes illustrate the aspects of this categorisation process. The vacation in Switzerland was made less painful because of the possibility of setting up a Swiss lecture mental account, from which the expenditures could be deducted. Similarly, the notional United Way mental account is a flexible way of making losses less painful.

Finally, the third component of mental accounting concerns the frequency with which accounts are evaluated and what read; Loewenstein and Rabin (1998) have labelled 'choice bracketing'. Accounts can be balanced daily, weekly, yearly, and so on, and can be defined narrowly or broadly. A well- known song implores poker players to 'never count your money while you're sitting at the table'. An analysis of dynamic mental accounting shows why this is excellent advice, in poker as well as in other situations involving decision making under uncertainty (such as investing).

Thlar (1999) stated that “primary reason for studying mental accounting is to enhance our understanding of the psychology of choice”. Understanding mental accounting would bring obvious understanding about the choice making decision. Accounting decisions such as to which category to assign a purchase, whether to combine an outcome with others in that category, and how often to balance the 'books' can affect the perceived attractiveness of choices. They do so because mental accounting violates the economic notion of fungibility. Money in one mental account is not a perfect substitute for money in another account. Because of violations of fungibility, mental accounting matters.

- Credit card

In Thaler’s (1999) work, Thaler narrowed four concepts of mental accounting, transaction utility, open and close account, advance purchase, sunk cost and payment depreciation, and payment decoupling. The payment decoupling means prepayment separates or 'decouples' (Prelec and Loewenstein, 1998; Gourville and Soman, 1998) the purchase from the consumption and in so doing seems to reduce the perceived cost of the activity. As a one of mental accounting concept, mental accounting concepts the payment decoupling would be related with credit card debt default.

Normally the payment decoupling related with prepayment, for instance, in the wine example, the prepayment separates or 'decouples' (Prelec and Loewenstein, 1998; Gourville and Soman, 1998) the payment from consumption and in so doing seems to reduced cost of activity (.Thaler 1999). Prepayment can often serve this role, but the mental accounting advantages of decoupling are not all associated with prepayment.

Thaler lies that perhaps best decoupling device would be credit card. Credit card store are willing to pay more than 3 percentage or more of their revenue for service charge to credit card Company (Feinberg, 1986; Prelec and Simester, 1998). Thaler illustrate that credit card decouple purchase from payment in several ways.

First, it postpones the payment by a one-month in general. This creates two effects: payment is later then purchase, and payment is separate from the purchase. It would be useful for some consumer who struggle in liquidate constraint. However, Prelec and Loewenstein (1998) stress, ceteris paribus, consumers prefer to pay before rather than after, so this factor is unlikely to be the main appeal of the credit card purchase. But the separation between purchase and payment in time gap would be cause to consumer could not clearly remember price to they paid Soman (1997) found that “students leaving the campus bookstore were much more accurate in remembering the amount of their purchases if they paid by cash rather than by credit card. As he said, 'Payment by credit card thus reduces the salience and vividness of the outflows, making them harder to recall than payments by cash or check which leave a stronger memory trace”

Second factor that credit card decouple purchase to payment would be that once bill arrived, the purchase would be mixed with many others. Compare with the situation that paying $50 in cash at the store, adding a $50 item to a total $843 bill. Psychophysics mentioned that the $50 will appear larger by itself than in the context of a much larger bill, and in addition when the bill contains many items each one will lose salience. The effect becomes even stronger if the bill is not paid in full immediately. Although an unpaid balance is aversive in and of itself, it is difficult for the consumer to attribute this balance to any particular purchase.

To sum up, mental accounting lies that credit card user would have a different psychological sense to use card compare with pay by cash. However, it would be interesting to argue that, if consumer has such psychological confusion to use credit card. There must be legal protection, like regulations to usage or issuing credit card based on ‘Duty of Care”, which Australian High court deviated from British approach. If result of this research illustrates that consumer even aware enough, but became a credit card debt defaulter because of their credit card debt, the mental account theory should be rejected to explain the CCDD case, and new consumption theory, which explains financialisation era consumption, should create.

- Mental accounting concepts in survey

This project would be designed empirical research, mainly survey for CCDDer. Organisation of survey questioner sheep would be main difficulties that will fact to researcher. Main question is ‘which aspect was a main aspect to cause CCDD? Consumers, themselves, who could not understand CC or fail to control their spending, like mental accounting approach, or systemic failure would be a aspect to cause the debt default case”. This part would not be concern about technical aspect of survey questionnaire sheet. But it will focus more principle to organised survey questions.

From the basic question in this project, first question that finds correlation between CCDD and mental accounting that should be added in the questionnaire sheet. From Thaler (1999), credit card usage would be because psychologically payment decoupling effect to credit card user. Hence, half of questions should relate with discovering payment-decoupling issue in the CCDDer’s debt default. And also half of questions should relate with survey participator’s personal economic situation before default. It would be contain all items in household balance sheet, like level, and sort of household debts, including proportion of consumer debt level. And it should be include effect of Assets price change, if participator owns house or applied consumer loan, in consumption.

From the two different sorts of questions, analyst would measure which question group would be significant effect the personal bankruptcy. There would be four possibility of result in logic. First one would be, there were mental accounting effect with no systemic consequence, second case would be mental accounting effect with economic consequence. Third case would be participator did not have a mental accounting effect, which means CCDeerawared financial situation that moving to Debt default, with no systemic consequence. And last case would be participator did not had a confusion causing by mental accounting effect, but have a systemic consequence, means financial difficulties. Proportion of the Four result would be main source of conclude this project.

It would be not easy to argue that generalised as an academic theory from result of research, effect of mental accounting in Australian credit card debt defaulter group, because the result would have a geographical limitation, Australia, and sample population would be issue, if survey could not research reasonable number of sample population. And also time line would be issue because the qualitative method, survey should finish in certain period including the length of researcher’s visit in Australia, under the British Law, legal condition of T2 visa holder, cannot stay outside of UK more than two months.

If there are sample mental accounting researches or working papers, it would be good role model of this research. But unfortunately it is not easy to find it. However, without precedent research, this research would be useful to detect role of mental accounting in conventional consumption theory, re-examination in Australian case. If result is not matched with mental accounting theory, for example participators did aware that they are over consuming credit card with reason, economic difficulty or without reason; this project would be a case that claims one of the behaviour economic theory. And furthermore, mainstream economic should move to liquidity constraint argument rather than freedom of personal choice.

Gap of literature review

- Conventional consumption theories

From the literature review, it is obvious that, mental accounting would be conventional economic theory to explain the Australian CCDD case. It is personal choice to default credit card payment, and the 18 present of Australian consumer would be punished by financial and legal system, causing their misbehaving. It means that lest of 82 percept of Australian consumer would be fine because they did not made such misbehaviours? The question that rise is what would be consumption theory that is able to explain the Australian consumer, which is significantly depend on consumer loans for maintain their life style?

Tobin’s contributions about liquidity constraint would be one of the answers. It is theory that when household has a not enough income or assets that liquid to consume, product in financial market would be solutions. Simply, the theory suggests that using debt to purchase life necessaries constantly. If household makes a balance between consumer loan and real income, in some case it would be an assistant to running the debt-supporting consumption cycle. But low income household would not make it.

Many research related with Australian consumption related with credit card are published before 2008 or some case 1990’s. it is not clear the articles still represent recent Australian credit card default case. Recent study about the household debt related with lower income household would be trend in Political economy study. But it was hard to find enough number of articles about Australian relative poverty, causing by credit card debt or default, especially about the behaviour perspective, CCDDer research. Maybe it is newly raising issue in Australian economy. However, further research would be requested.

Also study about recent trend in Australian credit card industry would not be easily searched. It would be reasonable to research about the credit card industry facing little bit less 20 per cent of default rate. Possibility would have a research or adjustment plan but on public it was not easy to find.

Recent industry reform was in 2001 reform of credit card schemes (Katz 2001). Even it referenced 69 times, mainly article about credit card fee charging, but The book was published almost two decade ago. Many article that referenced were published early 2000’s. As a result, it would not be suitable to mention the article would explain recent Australian credit card industrial situation.

Another section that related with behaviour economic research Australian consumption research, mainly it related with environmental approach rather than debt default, and also the publishing year were many cases, before 2010. From research it was really hard to find behaviour economic approach articles that related with Australian credit card debt default case. It was more concern about eco-friendly and public health issue, like alcohol consumption, and comparison research with UK case.

To sum up, consumption theory related with credit card usage are limited, especially in Australian case, the number are small. And resent articles about Australian consumer poverty that causing by credit card debt default was hard to find.

- Marxist Consumption Theory

It was hard to find a Marxian consumption theory. In Marxism tradition, there were many mentions about consumption, but as an economic theory, it was a hard to find in this literature review. From Grundrisse (p88,Marx 1993), Marx had a idea circulation of two different activities, that consumption is production, and production is consumption. But Marx lies that there must be production first, which shows concern more about production in the cycle. Like first mentioned about production in volume of ‘Das Capital’. For example, Marx thought regime of production creates a need for consumption not opposite.

However, there is some recent research about consumption in Marxian traditions. Ben Fine has been published one volume of book, called “The world of consumption” with Ellen Leopold in 2002 (fine & Leopold 2002). And there were more academic articles for lies his idea about consumption (Fine 2013, Fine 2008). The results of research do not directly related with consumption credit study or credit card debt default case, but it would be useful to highlight the results for

Fixing boundary and choosing some academic aspects concern for this project.

Fine (2002) lies six achievements, getting in their study of conventional consumption theories in the book, which are first, there were contribution both wide ranging and diverse, second, rational choice methodologies or those more generally based on methodological individualism, have made little headway in the literature in consumption. Third, study of consumption took a notion of consumer society or consumerism, fourth, the study of consumption has been highly conducive interdisciplinary. Fifth, consumption may have taken a production as a starting point. it has rejected a simple dichotomy between production and consumption, and finally, the study of consumption has increasingly sought to intergraded material and cultural factor. There are limitation to describe the contribution would be a Marxian consumption theory, because it is only focusing observation and critique of recent conventional consumption theories.

About first achievement, which is contribution both wide ranging and diverse. Fine (2002) explains that “there are no more find that study of consumption that are motivated rationalised by wish to balance its neglect relative to production” (p3 find 2002)). Also Find (2002), referenced Quartaert (2000) ‘the consumption of goods not their production, drives history, modernity is also marked by its ascendary of the consumer over the producer”. It means that current conventional consumption theories focusing consumption a s a starting point of their research rather then start for production stage for analysis.

Fine and Leopold’s work (2002), second achievement is that there are less rational choice theories in conventional consumption theories, lies that economics and psychology are candidates for the rendering. This analysis is related with this project, which test behaviour economic theory in Australian CCDDer’s decision-making mechanism. Fine and Leopold mentioned that “The two obvious candidates for rendering this otherwise are economics and psychology”. And continue “this is despite the success with which economics imperialism is currently swapping, albeit unevenly, across the other social science”. This is idea that sharing with this project, and honestly one of the aim that want to achieve throughout research result.

Third achievement that lies in the book is idea of consumer society or consumerism. Chapter eight titled ‘what is consumer society?’ fine and Leopold (2002) introduced pioneer work in the field, Mackendrick et al (1982), which explains it was a historical destiny to build consumer society. Fine posted opposite view about the consumer society by Humphery’s (1998) work lies that “participation in consumption culture as socially destructive’. Humphery has been also mentioned with less negative approach after.

Consumerism would be contents that explain as a one of aspect of modern consumer society in Australian CCDDer research, because it is related with behaviour economic perspective of consumption. David Laibson’s ISH would be good instance of the fine’s third achievement.

Fourth, Fine lies that the study of consumption has been highly conducive to inter-disciplinary. It continued “Initial phase in the literature was marked by the simple intra-disciplinary application of readymade, off-the-shelf theory to consumer and consumed, but this has been given way to fertilisation across disciplines in the appropriate recognitions that the subject of consumption knows no analytical boundaries”. In mass production era, it might be natural to imagine mass consumption products for public. But this project would be research failure of new type of mass financial product, which is credit card debt default.

Fifth, the simple dichotomy would be rejected. According to Fine and Leopold (2002), because consumption may have taken production as its point of departure, it has increasingly rejected a simple dichotomy between production and consumption. Fine explained that, “the literatures had a incorporated other, intermediate activities between production and consumption, and recognised them to be of significance. This is tire of design, retail, advertising, shopping, and so on”.

Finally, Fine lies that the study of consumption has increasingly sought to integrate material and cultural factors. Every object and the way perceived are linked to one another, and processes by which they are brought to the consumer and used. It would be natural that majority of commodities and social reserve dealing in market in capitalism society. But new trend is some intangible items can trade in market system, such as debt or default possibility in security market. Without arguing about the new financial items in traditional accounting perspective, it is obvious that it is not enough to explain or describe the new phenomena by culture and material aspect.

To sum up, there would be Marxian critique of mainstream consumption theories, which is influenced by utility maximisation or material fetishism as Fine and Leopold lies. However, there are some limitations in the memorable work.

One of limitation of the Marxian study of consumption theories might be that it would be an critical analysis in Marxian school perspective, but it does not mean the work is explaining recent consumption with their theoretical aspects, like production, labour, especially consumption pattern in financialisation era that heavily depend on consumer loan.

Another limitation would be that due to absence of Marxian consumption theory, it would be hard to influence to conventional school or in policy influence for solving recent consumption problems, which is rising, including CCDD issue in this project.